Free travel. It’s this, hazy, nebulous thing that seems so far out of reach, am I right? Like the neighbor’s cat who sits right next to your porch and sunbathes all afternoon but runs away every time you reach out to pet it. I don’t really know what travel has to do with your neighbor’s cat, but I feel like the analogy works, so I’m running with it. Anyway, you’re probably thinking, Pay for flights with points and miles? Only business people who travel all the time for work can rack up enough miles for that. I could probably only get enough miles for one domestic flight every nine lives! (See what I did there, tying it back into the cat thing?)

Well, you’re wrong.

Sorry, but somebody had to say it.

Here’s the thing: flying is probably the least effective way of racking up points and miles to put toward free travel. Unless you splurged on a big trip to Asia and earned a crap ton of miles in one go, little jaunts from Dallas to Denver aren’t gonna get you anywhere fast (except for from Dallas to Denver, which, by the way, is a super cheap route). So how are you supposed to collect all those points and miles for free travel? Well, I’ll tell you. And fortunately for you, most of them don’t involve any more spending than you’re already doing. Some don’t involve any spending at all. So buckle up, get out the notepad, and toss out a handful of table scraps for the neighbor’s cat, cause we’re about to go on a ride. Here’s how to get the most points and miles for free travel fast.

Get a credit card

There’s no faster way to collect points and miles than with a travel credit card (or three). Like cats, the more the merrier (Although after about 7 or 8 you should probably start asking yourself if you’re making wise life choices). Most travel rewards cards offer impressive sign-up bonuses after you spend a certain amount in a couple of months. Our fave is the Chase Sapphire Preferred card, which offers 50,000 bonus points after you spend $4,000 in the first three months. We also have the Capital One VentureOne, which we don’t use much anymore, but keep on hand because there’s no annual fee (The Chase card costs $95 annually after the first year). The VentureOne only offers 20,000 points, but you only have to spend $1,000 in the first three months to earn it. Obviously, when choosing a card (or cards), you should only sign up for the ones with bonuses you can actually obtain. But once you earn one bonus, feel free to sign up for another card for another bonus!

As for annual fees, you can certainly cancel the card after the first twelve months, but often you can choose to downgrade to a card from the same company with no annual fee, it’ll just mean you’ll probably be getting fewer points per dollar that you spend on the card. The Capital One Venture, for example, offers 1.5 points per dollar but has an annual fee. The VentureOne has no annual fee but you only collect 1.25 points per dollar. However, you can keep the points you accrued with one card and they’ll transfer to the other so you don’t lose your points but you don’t have to pay, either. Sometimes the annual fee is worth it though. Some sites have a slider that does the math for you by calculating how much you spend in a month, how many points you’d get, and whether the annual fee is worth it. Don’t you wish your cat was that good at math?

Besides claiming bonus points, you’ll obviously also want to use the card as much as you can on everyday purchases to collect points. Look for a card with higher point values per dollar spent for the best return on your spending. Buy everything with it (as long as you are good about paying it off in full at the end of the month; all those points aren’t worth it if you’re paying more in interest than the points will get you in travel). Pay for groceries, doctor’s appointments, clothes, electronics, cat food… Some utility and insurance companies let you pay with a credit card. If they do, do it! Forget cash. Forget you have a debit card. If at all possible, pay with your travel card and you’ll collect points and miles super fast. However, if your financial responsibility is lackluster at best (and stinks like last week’s kitty litter at worst), travel rewards cards may not be the best choice for you.

Full disclosure: your credit will have to be fairly good to get most cards that offer the best sign-up bonuses. But you can still earn plenty of points and miles with the cards available to folks with average credit. And if you’re worried about your credit score, don’t. Like cats, your credit score will land on its feet. If you have good credit to begin with, applying for or canceling a card or three every year won’t damage your credit, especially if you have several in your name that are current and active, even if you don’t use them. Think of it like the law of averages in math; everything balances out. So actually, the more cards you have in your name (up to something ridiculous like 17) and the longer you’ve had them, the less your score will take a temporary hit when you cancel an old card or are approved for a new one. Check out this list of some of the best travel credit cards 2018 edition.

Join Airline Reward Programs

Obviously, if you haven’t done it already, you’re gonna wanna join some frequent flyer programs. You can’t earn points with airlines when you do travel unless you have an account number. In fact, don’t ever get on an airline without also providing a frequent flyer number and getting rewarded for your travel. Ever. Just like you should never keep your cat in a hot car in the summer with the windows rolled up. Ever. Even if it’s not you who’s paying for the ticket (say your boss is footing the bill or you were offered a free trip to Florida from a small business supplier like my mom), your name is on the ticket so you are the only one who can get the miles. Start by signing up with airlines that offer flights to your preferred destinations and go from there.

Fun fact: airlines form alliances. Just like that horde of cats that lives in the alley at the end of the street. That means when you fly with one, you can get/use points with several others. Say you have a frequent traveler account number with American Airlines but not Qantas. You can usually type in your AAdvantage number when booking your Qantas flight and get AAdvantage miles for that flight to Australia. Likewise, if you have a ton of United miles saved up, you can often use them to book a flight on Singapore Airlines. Super cool, huh?

Obviously, the more loyalty you show to one particular airline the faster the miles will add up, but there are many other ways to collect miles with your airline of choice.

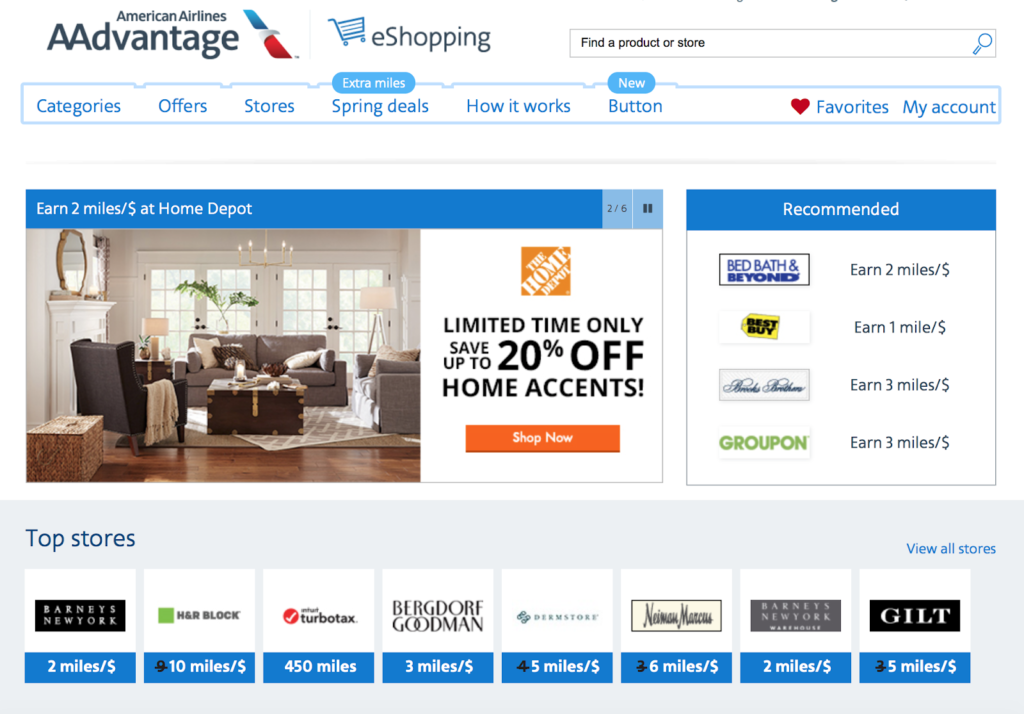

Get rewarded for everyday shopping

Almost every frequent flyer program offers some sort of e-shopping portal where instead of going directly to, say, petsmart.com to order cat food, you log into your frequent flier account, click on a special link that takes you to petsmart.com where you order your cat food and get miles for every dollar you spend. Cool, right?

In one week I earned something like 1,350 extra miles (not to mention the 2 points per dollar from using my Chase card) with American Airlines by using the AAdvantage e-shopping portal. Instead of going to Lowe’s to buy a ceiling fan that we needed and a few other necessities, I used the portal to order everything online and selected to pick it up at the nearest store. I earned 400 points by purchasing $200 worth of stuff with my travel credit card, but I also earned 2 points per dollar with American Airlines, plus an additional 500 because of a special bonus they were offering at the time. That’s 900 extra points, just by shopping online for stuff I already needed! The same week I filed my taxes with TurboTax and collected 450 miles just by clicking on a shopping link on my AAdvantage account page. I was giddy!

Of course, those points and miles were earned from fairly irregular spending (we don’t buy fans or file our taxes every month), but purchases I was going to make anyway earned me 1,350 miles with American Airlines, plus some 580 points on my credit card. Even if you don’t have big purchases coming up, if you spend $100 on home goods per month, $100 on electronics, $100 on clothes, $50 on office supplies and $50 on cat toys, that’s at least 1,200 points you could be collecting every month. That’s 14,400 points a year. That’s enough for a domestic roundtrip flight to many destinations. See what you could be missing!?

Points you earn through e-shopping will be added directly to your frequent traveler account, so pick the airline you want to earn the most points with and use their portal. Websites like Groupon, Macy’s and Target can often be found on the list and a bunch of websites you probably wouldn’t have thought of, from ink cartridge retailers to website hosting companies. Before making any purchases online, check the list and shop through the provided link instead of going directly to the store or website.

Get rewarded for dining out

Just like with online shopping, airlines will offer miles if you dine at certain restaurants. It works a little differently than e-shopping, but the principles are the same. For dining, you register a credit card (preferably your travel rewards card) with your fave airline’s dining program and then when you use that card at restaurants found on the list, you’ll get points for every dollar you spend. My advice: use this opportunity to tell your friends that it’s too much trouble to have the server split the bill. Just put it all on your card and have everybody Venmo their share. Brilliant, right? Of course, if there’s somebody else also trying to collect points, you might have to fight them for it, but cats contend for dominance all the time. Just make some loud hissing noises and arch your shoulders and they’ll back off.

You can only use each credit card in your wallet for one dining rewards program, though. Like cats, they’re very territorial and don’t like to share. However, participating restaurants are almost exactly the same across all programs, so switching back and forth won’t increase your dining options. Full disclosure: there aren’t generally many vegan options listed, so we get the short end of the stick on that one, though there are usually a fair number of local restaurants in addition to chains. Coffee shops can sneak in there, too, though, so check the list and make a note of what’s in your area. If you’re going to eat out anyway, might as well get rewarded for it.

Pay your bills

This one’s a downer for me as our utilities are included in our rent and we have to pay that in cash every month. Womp womp. You can’t win ’em all. However, if you live in a state where energy is deregulated (meaning you can choose your energy supplier), some airlines allow you to collect more points and miles by paying your utility bills through their portals. Energy Plus, Everything Energy, and Reliant Energy are a few of the more popular companies among airlines and all you have to do is sign up.

Log into your frequent traveler account and peruse your options. Some airlines reward you with points per dollar spent so your rewards will depend on your total bill, some airlines offer a sign-up bonus and then a set number of rewards for every month you pay. Just make sure when you sign up that you won’t be paying significantly more for your gas or electric than you were before just to collect more points and miles. You still need to be able to afford kitty litter, after all.

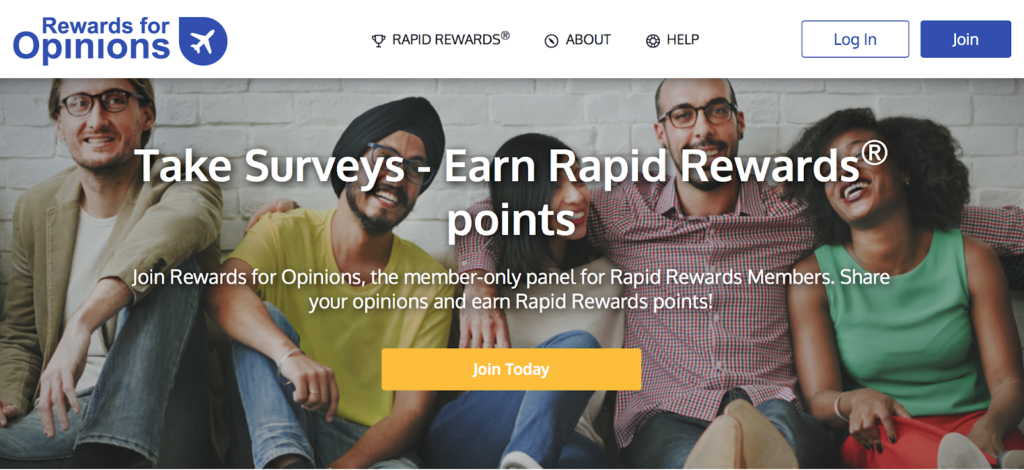

Use your spare time to take surveys

This one is my favorite when I still want to collect miles without having to spend any money. Most major airlines partner with survey sites to help members collect points and miles faster. You can use sites like e-Rewards to answer questions about shopping, business, and cat ownership in exchange for monetary values that can be “cashed in” for miles with participating airlines. Opinion Miles Club and e-Miles are a couple other options that offer set points per survey. There will be a link on the airline website that connects you to their preferred survey site. Just don’t be seduced by all the other ways you can use the points you collect, from magazine subscriptions to gift cards. Nobody likes cats who are easily distracted (I bought you this expensive feather on a stick, now play with it, darn it!)

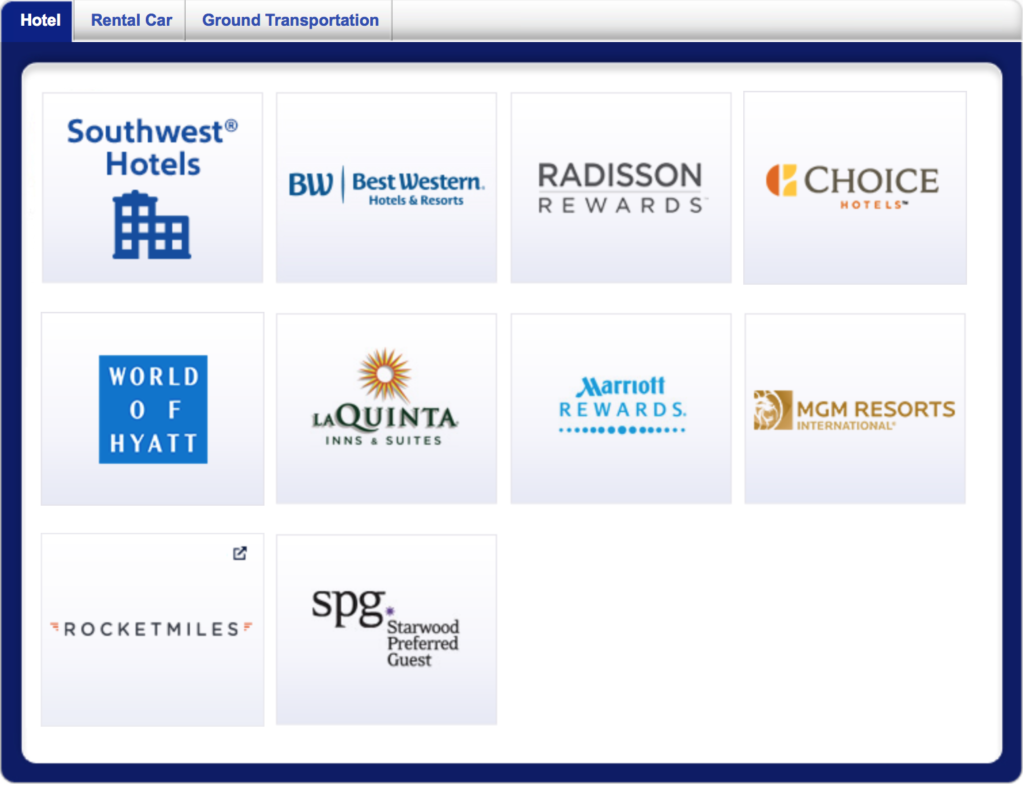

Book travel

When you do travel, be it for business or pleasure, check your frequent traveler accounts to see if you can get rewarded for hotel stays or car rentals. And it’s not always just airlines that offer specials; Capital One offers 10x the points if you book a stay (and pay for it with your Venture card) on Hotels.com through their special portal. Airlines can also offer awards if you book through partnering booking sites or with participating hotels. My advice: search for the best deal on whatever booking sites you usually use, then check with your fave airline to see if you can book directly with the hotel or through a different site like Rocketmiles to earn either bonuses or points per dollar. It’ll just take a few extra minutes and you might earn yourself a crap ton of points or miles. Some airlines even offer miles when you book with Airbnb or Lyft, so no matter your travel style, you can still collect miles.

And you thought flying was the only way to earn miles! Don’t you feel silly? But there’s no need to go sulk in the corner like your roommate’s cat after you accidentally stepped on its tail; just get out there and collect those points and miles like it’s your job! And if you’re as clever as your roommate’s cat with the now-crooked butt appendage, it won’t even look like you’re trying and you’ll be booking those free flights with the same look of smug satisfaction as Whiskers. Good kitty.

Wander on.

Alisha is a freelance outdoor journalist and photographer based in Ogden, UT. She loves backpacking, hiking, mountain biking, kayaking and snowboarding (even though she’s terrible at it). She’s also pretty sure she’s addicted to coffee. alishamcdarris.com